The banking system is the backbone of every country’s economy and India is not an exception, in fact, the Indian Banking System is the most regulated Banking system in the World. Reserve Bank of India or RBI is the Central Governing body for all commercial Banks in India and is solely responsible for regulating, monitoring, and implementing the policies and guidelines for the Indian Banking sector.

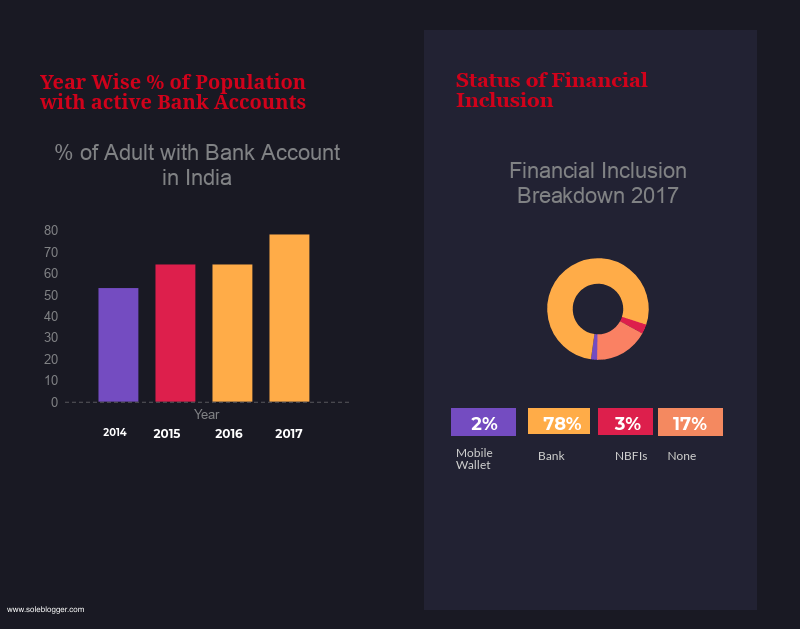

In a country of 1.35 Billion people, still, 195 million people still do not have basic Banking access in India, which is the second-highest in the World after China. (The unbanked Population of China is 225 Million, according to the survey report by the Global Findex Database, 2017). In percentage terms, 20.1% of India’s total population was unbanked when the Report was published in 2017.

Though the situation has been improving every year, due to Govt of India’s Financial Inclusion program which was launched in the year of 2014. Now anyone can open a Bank Account with Zero Balance and get all the basic banking facilities. To accelerate the process of Financial Inclusion, RBI has also granted the license to set up Payments Bank in 2015. But in reality, most of the accounts under PMJDY are inactive.

Here, in this article, we will comparatively analyze the top 6 best Banks in India based on customer satisfaction, product offerings, branch networks, Modern Banking Technology, and several other indicators.

Factors to be considered before opening the Bank Account

Here are the top factors you must consider before opening a Bank Account

- Purpose: What is your main reason to open an account with any Bank. For example, if you want to avail Home Loan in the future, then you should consider the Bank which has the lowest interest rate and Processing Fees with flexible tenure.

- Charges: One of the foremost reasons to select any Bank, consider those Banks that are transparent in their fee structure, have low charges, and have no hidden fees. Private Banks have very bad reputations in these areas.

- Technology: Digitalisation of the banking sector is one of the main focus areas of Govt of India, therefore, technology should be the most important criterion for the best bank. Today, all your banking needs can be done from a smartphone, therefore, a Good Mobile Banking App or online Internet Banking portal is one of the top reasons you should consider. A good bank also should have a digital paperless lending platform for MSME or Mortgage loans.

- Bill Payments: Bank’s online Internet banking portal should integrate all the Billers in India for hassle-free payments of Bills like Mutual Funds, Insurance, Visa Credit Card Payments, etc.

- Service Quality: India’s PSU Banks have a very bad reputation in this area, though they have now started to improve their service quality to compete with the Private Banks. Quality of Branch Banking should be given topmost priority.

- Branch Network: You must consider the Bank which has a very good branch network. If you are in any transferable job, then definitely consider the Bank which has branches in almost every place in India.

- Phone Banking: Every time, it is not possible to visit branches for any minor work, therefore a good Phone Banking service you must consider before selecting the right bank.

- Offers: One of the top reasons to choose the right bank that gives the most discounts and offers from the eCommerce websites. You can find a dedicated offer section on the Bank’s official website where the Bank provides the current offers or merchant discounts.

- ATM: You must consider the Bank which has a good number of ATM points at every place in India. You may withdraw money at any Bank’s ATM but there is a certain limit after which you have to pay charges for withdrawal or even balance inquiry.

Parameters considered for selecting the Best Bank

Here I consider the parameters for selecting the Best Bank in India

- Online & Mobile Banking

- Branch Network

- Fees & Charges

- Products

- Offers & Discounts

- Customer Care

- Customer Satisfaction

Top 6 Best Banks in India

In a country of billions of people, the Word Best Banks in India is a very relative term. There are a total of 12 Public Sector banks, 22 Private Sector Banks, and hundreds of Scheduled and Non-Scheduled Regional Rural Banks, Co-operative Banks, Foreign Banks, and Payments Banks operating in India. The term Best Bank in India varies from region to region and person to person. The Best Bank for any person may not be the best for the other person. It all depends on personal experiences & individual satisfaction.

If you are staying in any urban area then you might have access to several Bank Branches, and you can choose your favorite one. But if you are staying in any rural area, you might have only a single Bank Branch in your locality. Therefore, you do not have any other option to select.

Here is the list of 6 Best Banks in India considering several factors which we will categorically cover later in this article. The list contains both PSU and Private Banks in India. We consider customer satisfaction as the topmost deciding factor while preparing the list.

- HDFC Bank

- Kotak Mahindra Bank

- State Bank of India

- ICICI Bank

- Bank of Baroda

- Axis Bank Limited

Here’s how they Score on different parameters

| Name of Bank | Branches | ATM | Banking Technology Score | Customer Service | Charges | Visit |

|---|---|---|---|---|---|---|

| HDFC Bank | 7895 | 20462 | 3/5 | Very Good | High | Official Website |

| Kotak Bank | 1702 | 2963 | 5/5 | Very Good | High | Official Website |

| SBI | 22405 | 65627 | 4/5 | Poor | Low | Official Website |

| ICICI Bank | 5900 | 16650 | 5/5 | Good | High | Official Website |

| Bank of Baroda | 8205 | 9200 | 3/5 | Good | Low | Official Website |

| Axis Bank | 4903 | 15953 | 4/5 | Fair | High | Official Website |

Now, Let’s see how these top banks rank on their product offerings

| Name of Bank | Credit Card | SB/CA Accounts | Demat & Trading Services | Mutual Funds | Life/General Insurance |

|---|---|---|---|---|---|

| HDFC Bank | Excellent (5/5) | Good (4.5/5) | Fair (3/5) | Good (4/5) | Good (4/5) |

| Kotak Bank | Fair (3/5) | Excellent (5/5) | Excellent (5/5) | Good (4.5/5) | Good (4/5) |

| ICICI Bank | Good (3.5/5) | Excellent (5/5) | Fair (3/5) | Good (4/5) | Good (3.5/5) |

| SBI | Excellent (5/5) | Good (4/5) | Fair (3/5) | Good (4/5) | Good (4/5) |

| Bank of Baroda | Fair (2.5/5) | Good (3.5/5) | Poor (2/5) | Fair (3/5) | NA |

| Axis Bank | Good (3.5/5) | Good (3.5/5) | Fair (3/5) | Good (4/5) | NA |

Asset Size of Top 6 Best Banks as of 31.03.2023

Source: Wikipedia

1. HDFC Bank

HDFC Bank is the second-largest bank in India and ranked 1st in this list of best Banks in India. They are also named Number One Bank according to Forbes Magazine’s list of Best Indian Banks. HDFC Bank is one of the most reputed private sector banks, headquartered in Mumbai, and has more than 7895 branches spread across 2800 cities in India. The Bank also has the largest Credit Card base in the country. HDFC Bank is the largest Private Sector Bank in India with a total asset size is over 41 Lakh Crore Rupees (March 2023) post merger with parent HDFC, closed second of SBI.

- Top 10 Best Debit Cards in India

- Top 10 Best Banks in India for Housing Loans for the Salaried People

- Best Neobanks in India

HDFC Bank is the most valuable brand in India in 2019 by brand value according to BrandZ and the fourth most valued lender behind JP Morgan Chase, ICBC, and Bank of America in 2023.

HDFC Bank is so far the most secure Private Bank in India. You can easily change the mobile Number or update the Address from another Private Bank’s ATM or NetBanking portal, but you can not do it in HDFC Bank. Though many find this process very backdated, this is the right approach for the security of your Accounts.

HDFC Bank is the subsidiary of Housing Development Fin Corp or HDFC Ltd which is a big financial conglomerate. HDFC offers different services and products like mortgage loans, General Insurance, Life Insurance, HDFC Securities or Mutual Funds, etc.

HDFC Bank does not offer its own home loan or insurance products, it just markets the products and services for its parent company Housing Development Fin Corp or HDFC Ltd. (HDFC Ltd. merged with HDFC Bank, wef July 1, 2023)

HDFC Bank is the largest Private sector Bank in India in terms of Market Capitalization. HDFC Bank has also the best Asset quality among all Indian banks.

HDFC Bank is the first bank in India to introduce the AI-powered conversational chatbot named EVA (Electronic Virtual Assistant) in the Indian banking system.

Why should you Choose this Bank?

- Second largest lender and largest private lender in India. Big Brand in the Indian Banking Sector and the most valuable brand in India by brand value.

- Largest credit card base in India.

- Most secured Bank amongst all Private Banks in India.

- The international transaction enabled Visa Debit Card. You can activate International Transaction rights from HDFC Bank’s net banking portal.

- Excellent branch network, with more than 7800 branches located in almost every urban or semi-urban area in India.

- Good customer service, Phone Banking support, and trained & professional branch staff.

- Excellent Bank for corporate salary Account holders.

- AI-fueled Conversational banking chatbot software with text and voice-based interface to perform banking tasks.

- Get transaction updates on WhatsApp.

- Feature-rich Debit cards with EMI on debit card facility for selected customers.

- Very good service for the Current Account holders, dedicated relationship manager for corporate customers.

- More transparency regarding charges, fees, and rates of interest on different loan products.

- With exclusive Offers and Discount programs with various eCommerce websites in India, the HDFC Bank credit card is ranked one of the best in India in terms of providing various merchant discounts and offers.

- Register Mutual Fund SIP URN or Loan ECS mandate both from NetBanking and Debit Card.

- You can find every product like HDFC Mutual Fund, Life Insurance, General Insurance, Demat & Trading Account, and Health Insurance in a single place.

Why should not you choose this Bank?

- Charges and Fees are very high. Thoroughly check the terms & conditions before availing of any retail or personal loan from HDFC Bank.

- You have to maintain a very high minimum balance, Rs.10000 in urban areas and Rs.5000 in rural and semi-urban areas.

- Mobile Banking App is not very intuitive comparing other bank’s mobile banking apps.

2. Kotak Mahindra Bank

Kotak Mahindra Bank is one of the most highly reputed and technologically updated banks in India. Their customer service is the best among all Indian Banks in India. Founded in 1985, as Kotak Mahindra Finance Ltd, Kotak Bank is now the second-largest Private Bank in India after HDFC Bank in terms of Market Capitalization. In the year 2015, Kotak Mahindra Bank acquired Bangaluru-based private Bank ING Vysya Bank.

Headquartered in Mumbai, Kotak Mahindra Bank has around 1700 branches in India. The Bank offers a wide range of Products from Investment to Credit. Kotak Bank is also the best Digital Bank in India in terms of Banking Technology. You can create a free Digital Bank Account with an International Transaction enabled Visa Virtual Debit from Home within 5 minutes and do not have to maintain any minimum balance.

Kotak Bank is also an excellent Bank to open corporate salary Accounts and Current Accounts for businesses with auto swap facilities. Their Trading Account is the best 3 in 1 Trading Account Service amongst all Indian Banks in India.

The Bank offers a wide range of banking products from Investment to Insurance & Wealth Management. Kotak 811 and Kotak 811 Edge are the best digital savings accounts today in India.

Kotak Bank is also the first Bank where you can register the recurring Auto-Debit mandate for Mutual Fund SIP URN or Loan EMI ECS from both a Debit card and NetBanking.

Why should you Choose this Bank?

- Excellent Internet Banking & Mobile Banking App in India.

- Instant Digital Bank Account with international transaction-enabled Virtual Debit Card.

- Best 3 in 1 Trading cum Savings Account in India.

- Dedicated relationship managers for corporate Banking customers.

- Register recurring eMandate for Loan EMI ESC or Mutual Fund SIP both from the Debit card and Netbanking.

- Good Phone Banking Service.

- Kotak Moneywatch, Personal Finance Manager.

- High savings interest rate. Auto-swap facility for Current Account balance.

- Excellent Offers and Discount programs with various merchant websites.

Why should you not choose this Bank?

- Very Low Branch & ATM Networks.

- High minimum balance requirement for regular Savings or Current Accounts.

- Kotak Bank’s Credit card section is not as popular as HDFC, CITI, or SBI Credit Card services.

- Not very transparent on their Fees and Charges. Kotak Bank has started taking charges for UPI Money Transfer Service.

- Thoroughly check the Interest rate, Processing fees, pre-closure charges, etc., if you want to avail of any retail loan or business loan from Kotak Bank. Like other Private Banks, Kotak Bank also has a very bad reputation of deducting hidden charges from the account.

3. State Bank of India

No need to give any introduction to SBI, India’s largest bank, with more than 23% of the market share in India’s banking sector. SBI ranked 236 in the Fortune Global 500 company list in the year 2022, though they could not even rank among the top 10 best banks according to the Forbes list of Best Bank India 2019. Though we can not deny the influences of SBI in India’s Banking system and we rank 3rd in the list of the best banks in India.

Today SBI is the largest and most profitable company in India and one of the best technologically advanced banks in India. You may find SBI branches and ATMs in every corner of India.

SBI is the largest Bank in India with huge branches and ATM networks across the country. Though it is not a Government of India bank technically, it is a wholly-owned subsidiary of RBI, and the majority of its share is owned by RBI.

SBI is lately coming up with all the products the Private banks offer in India. Their Credit Card and Mutual Fund section is the most prominent and competes with HDFC & CITI Bank. SBI Mutual Fund AMC is now the largest MF AMC in India toppling the HDFC AMC. Their approach to treating customers is also changing.

Why should you Choose this Bank?

- Huge branch and ATM network, you can find the SBI branch or ATM at every corner of the city, even if it is an urban area or rural area. Cardless cash withdrawal from the Yono Mobile Banking App.

- Fees and charges are more transparent and less than private banks in India.

- SBI Credit card section is one of the best in India, SBI owns 60% of the share, and the remaining 40% is owned by Carlyle Group.

- Low minimum balance maintenance, in urban areas Rs.5000, in semi-urban areas Rs.3000, and in rural areas, it is Rs.1000.00. (Updates: SBI recently waives the minimum balance requirements from all types of savings accounts)

- Best Bank for Home Loan, has one of the lowest interest rates in the market, though their interest rate on MSME loans is somewhat higher than other PSU Banks.

- Digital and instant MSME Loan from mobile.

- Special Packages for corporate salary Accounts.

- Dedicated relationship manager for their corporate customers.

- One of the best Internet banking portals in India, the mobile banking app is also very good.

- Very good offers & discount programs for SBI credit holders in India.

- EMI on debit card facility on several eCommerce websites.

Why shouldn’t you choose this?

- Poor customer service at the branch level. (This may be due to the Staff shortage, but the bank has many digital alternatives).

- Staff are busier selling third-party products rather than Banking.

- The interest rate on Business Loans is somewhat higher than the other PSU Banks.

- Does not offer an internationally enabled Debit Card for Savings Account Holders.

4. ICICI Bank

ICICI Bank Limited (Industrial Credit and Investment Corporation of India) is so far the most innovative bank in India in terms of implementing Banking Technology. They are the pioneers of several new technological innovations in India. ICICI Bank was launched by Industrial Credit and Investment Corporation of India in the year 1994, later both of them merged together to form a single entity.

Headquartered in Mumbai, ICICI Bank has 5900 Branches and 16650 ATMs across India and is one of the largest private-sector banks in India. (Second largest Private Sector Bank in terms of Asset Size)

ICICI Bank was the first bank in India to introduce the Mobile Banking App in the year 2008, internet banking in the year 1996, and introduced the first contactless debit card in India. ICICI Bank has a wide range of banking products from loans to investments. ICICI Pru is the third-largest mutual fund AMC in India.

ICICI Bank is one of the first banks in India, has introduced the Positive Pay on iMobile Application to safeguard the checkbook issued by the bank. The service can be available from the iMobile Cheque Book service menu. ICICI Bank’s latest technological update is the lending platform, iLens.

If you are a Banking Tech freak, then I must recommend this Bank.

Why should you Choose this Bank?

- Most innovative and user-friendly mobile banking and online banking platform.

- Good Branch Network across India.

- A digital paperless lending platform for MSME and Mortgage Loans.

- Excellent Phone Banking and customer care service. You can complete several minor works from Home.

- Very good Offers and discount programs with various eCommerce merchants’ websites in India.

- ICICI Bank Debit card is International Transaction enabled.

- You can avail yourself of all the banking products from a single platform.

- Reward Points Program with PayBack the number One rewards points program in India.

- Professional and trained staff to cater to your all banking needs.

Why should you not choose this bank?

- Require to maintain a high minimum balance for both savings Bank and Current Accounts.

- High fees and charges. Not very transparent on their Fee structure.

- Bank staff always try to sell all the third-party products rather than banking.

- Credit Card is not so good as compared to the other credit card providers in the market like HDFC Bank or CITI Bank Credit cards.

5. Bank of Baroda

Bank of Baroda is the second-largest bank in India in terms of Asset size and the third-largest lender in India after SBI and HDFC Bank. After merging with Dena Bank and Vijaya Bank in the year 2018, the total Branch network of BOB is 9200, making it the third-largest PSU Bank in India after SBI and PNB. Bank of Baroda has the most number of Foreign branches amongst all the Indian branches (A total of 104 International Branches) making it the first Indian International Bank.

Bank of Baroda has the best service quality amongst all PSU banks in India. BOB has a more customer-centric approach than the Private Banks in India, though they have much fewer Banking Products of their own, mostly BOB ties up with third-party companies to provide Insurance, Mutual Funds, and other Banking products. BOB has also credit card services for its customers, though not as popular as SBI or HDFC Bank credit card services.

Why should you Choose this Bank?

- Wide Branch and ATM Networks after merging with Dena Bank and Vijaya Bank.

- Excellent 3 in 1 Trading cum savings Account.

- Most international Branches.

- Low Charges and Fee structure for various Banking services.

- Very low minimum Balance requirement for Savings and Current Accounts.

- Excellent mobile Banking App. Digital MSME loan from mobile.

- Very Good NetBanking portal.

- Best Bank for inward remittance of Foreign currency.

Why should you not choose this bank?

- Credit Card service is not very popular.

- Branch Network not widely distributed across India, mainly covers Southern and Northern parts of India.

- Fewer banking products to offer than other top Banks in India.

6. Axis Bank Limited

Axis Bank is the third-largest Private Sector Bank in India and has the largest number of ATMs amongst the Private Banks in the country. They have Branches and ATMs equally distributed across all geographic locations in India. Currently, Axis Bank has 4903 branches and more than 15900 ATMs in India.

Axis Bank’s ASAP Account is one of the best Digital Bank Accounts in India. They have also a wide range of banking products from Retail to Corporate Banking and are one of the best banks for SME lending.

Axis Bank was launched in the year of 1993 under the administration of Unit Trust of India and LIC of India and named UTI Bank. Later in 2007, the name UTI Bank was changed to Axis Bank Limited. LIC is the largest individual shareholder of Axis Bank.

This is the first Indian bank to introduce a dedicated innovation lab in Bengaluru. The Bank also has a very good mobile Banking App and NetBanking Portal.

Axis Bank acquired Gurgaon-based UPI Payment cum wallet App Freecharge from Snapdeal in the year 2017.

Why should you Choose this Bank?

- Largest ATM Networks amongst the Private Banks in India.

- One of the best Digital banks in India.

- Very Good Mobile Banking App.

- International Transaction Right enabled virtual Debit Card.

- Offers a wide range of Banking Products from Retail and corporate to Investment Banking.

- Very Good Offers and Discount programs with eCommerce merchant sites in India.

- Multi-currency Forex Cards for International Travel.

- Wide ranges of Credit Card.

Why should you not Choose this Bank?

- Very high Minimum balance requirement like the other private Banks in India.

- Not very transparent in their Fees and Charges. Unnecessary deducts charges from the Account.

- Customer Service is not as good as other Private Sector Banks.

- The rate of Interest on retail loans is very high compared to other lenders.

- The quality of credit card service is not as good as HDFC Bank or SBI.

Which is the Safest Bank in India?

All the commercial banks in India have a Deposit Insurance Scheme up to Rs.1.00 Lacs under Deposit Insurance and Credit Guarantee Corporation (DICGC), a subsidiary of RBI. In the recent Budget 2020, the amount has been raised to Rs.5.00 Lacs. The deposit insurance scheme will cover your savings and current & fixed deposit balances including the interest accrued. The maximum upper limit is Rs.5.00 Lacs including all your deposits from the same bank. If you have any deposits in any other bank, the same insurance will cover up to the maximum limit of the other bank. If any bank goes bankrupt, then you may get only Rs.5.00 Lacs from the particular bank from DICGC.

Now, if you are looking for the best & safest Bank in India to secure your hard-earned monies, then I will recommend you select the Bank which has the best Asset Quality. That means which bank has a lesser percentage of Gross NPA to total Loan Portfolio. The PSU bank’s GNPA comes down to 9.54 percent as of March 2021, whereas Private Sector Bank’s GNPA has increased from 3.2 percent to 4.8 percent from the last year. Though every Indian Bank tries to under-report its actual NPA figure, to show more profit.

If we consider Asset Quality as the best-ranking factor for selecting the safest bank, then HDFC Bank has the best Asset Quality amongst all the Indian commercial banks with an NPA percentage of 3.9 percent. Amongst the Private sector banks, Kotak Mahindra Bank has also a very good asset quality. Amongst the PSU banks, all the banks have been able to lower their GNPA percentage which is around 9.54 percent. Therefore, in my view, the safest banks in India are HDFC Bank, SBI, Canara Bank, and Kotak Mahindra Bank. Though I will always recommend you, try to diversify your deposits in different banks. I have already written an article on the best savings bank accounts in India, you can read the article here

If you want to open Online Insta Savings Account today, this article might help you

Final Word

These are the top 6 Best Banks in India right now to open a Bank Account. But again as I have mentioned earlier Best Bank is a relative word, it’s a matter of personal choice and varies from person to person. Some prefer PSU Banks for safety and some prefer Private Banks for Service Quality. You won’t find any complete Bank that fulfills your all Banking needs.

After the recent Government of India announcement, there are only 12 Public Sector Banks after March 2020. The above ranking of banks may change in the future after the amalgamation of PSU Banks.

Above, in this article, I try to cover the Pros and Cons of the top 6 banks in India. If you have any other recommendations, then don’t hesitate to leave your comments below.

If you like the article, then don’t forget to like our Facebook Official Page and share the post with your friends.

You can connect with me on LinkedIn and Twitter.

Thanks for the exact information dear for the best banks!

Nice quality article

I never have anything good to say about Axis or ICICI bank in terms of customer service. They are the worst banks you can come across in your life. It’s surprising to see them as a part of this list

Axis, Kotak and ICICI on crash list. Good options are private : HDFC, and Govt : Canara/BOB.

Axis Bank is next one to crash.

Nice Article . I like it. You may like our article too.